3 Penny Stocks To Watch On Thursday: $JCP, $PLUG, $PTN

Penny Stocks Are Getting More Attention As The Small-Cap & Micro-Cap ETF’s Outperform The Market; What’s Next?

One of the most attractive aspects of penny stocks is the share price. The fact that they trade below $5 makes it is possible for investors to buy them in bulk. Therefore, even if those stocks move by a small dollar amount, it’s possible to make decent money.Right now we’re seeing a lot more attention placed on small-cap and micro-cap companies. In fact, compared to the S&P (SPY), the Russell Small-Cap (IWM) has performed incredibly well over the last week. In an interview with CNBC’s Closing Bell on September 11, Steven DeSanctis of Jefferies thinks that “small caps can continue to outperform.”

[Read More] 4 Penny Stocks To Watch Amid Latest Biotech Deals

But, at the same time, it is important to remember that there is very little activity in penny stocks. This is compared to large-cap counterparts. Liquidity is often lower. In such a situation, it is important to keep an eye on the market and watch the direction of momentum. This said, here is a look at three penny stocks to watch on Thursday.

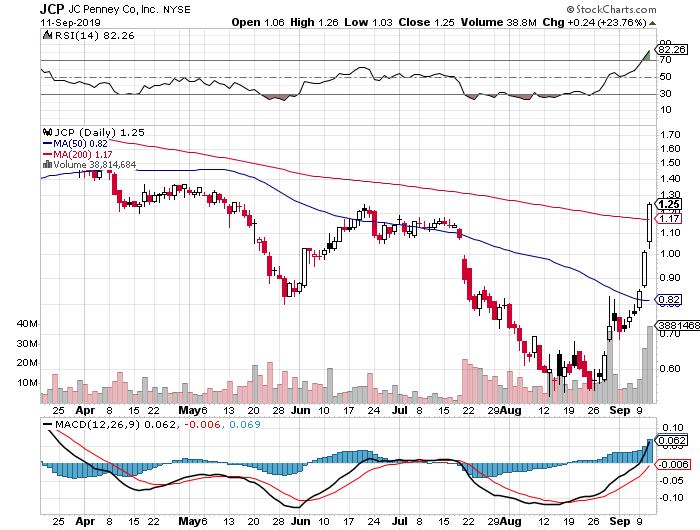

Penny Stocks To Watch #3: J. C. Penney (JCP)

The first penny stock to watch is departmental store chain J. C. Penney Company Inc (JCP Stock Report). The company has been in the doldrums for quite some time due to its mountain of debt. This runs into billions of dollars. However, the company is now making significant changes to turn around its business.

Earlier on, news about the company’s top executives buying up J. C. Penney shares in bulk had triggered a surge as well. Since August 13, shares of JCP have recovered by more than 100% & premarket highs have already hit $1.31.

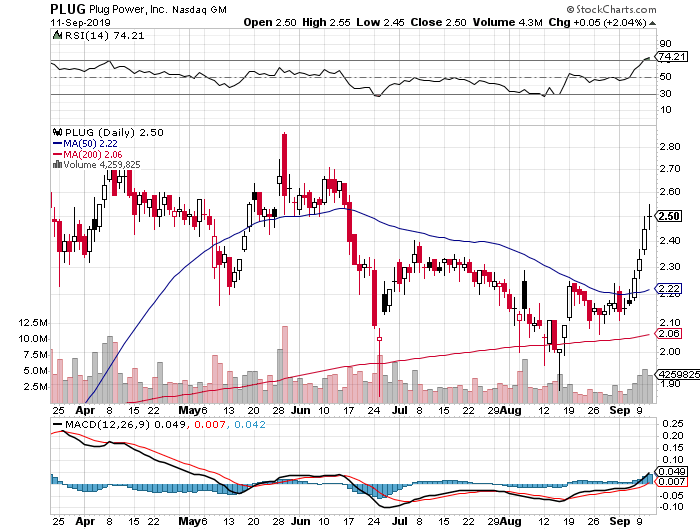

Penny Stocks To Watch #2: Plug Power (PLUG)

Another penny stock that made a significant move this week, Plug Power Inc (PLUG Stock Report). This came after the company made a major operational announcement. Plug Power announced that its new facility in Rochester is going to be expanded considerably. This came less than 12 months after it had been opened.

[Read More] Top 10 Penny Stocks On Robinhood To Watch For September

This shows that the company believes that its business is going to expand considerably and hence, it is definitely a stock that is worth tracking. PLUG stock has climbed by as much as 28.5% since August 15. As of premarket trading on Thursday, PLUG hit early highs of $2.57.

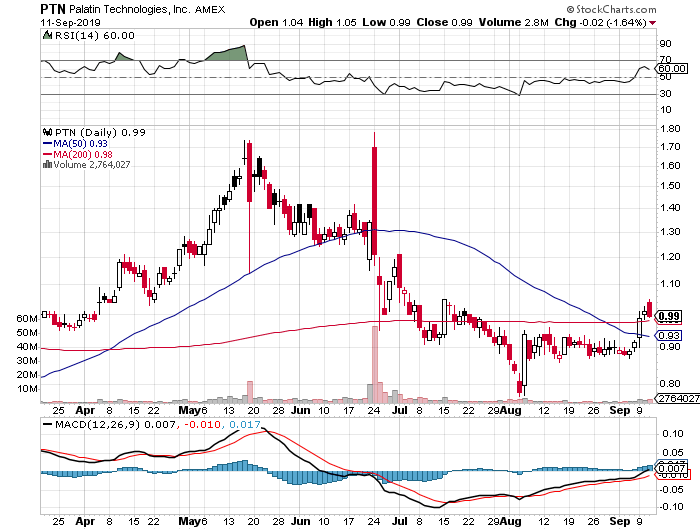

Penny Stocks To Watch #1: Palatin Technologies (PTN)

Shares of biopharmaceutical company Palatin Technologies (PTN Stock Report) have seen a considerable rise in price over the last week. The momentum continued on Thursday after the company announced fourth quarter and fiscal 2019 results. Highlights included over $60 million in revenues.Palatin also reported EPS of $0.23 up from $0.06 during last year’s period. This 283% increase in EPS was helped by the company’s performance over the last few months. Shares hit highs of $1.07 during premarket trading on Thursday.

“The last year was a landmark one for Palatin . We are proud of the recent FDA approval of Vyleesi and the continued advancement of our pipeline programs. The FDA approval is an incredible achievement and milestone, and we are excited that premenopausal women now have a safe and effective, as-needed option available to them for the treatment of acquired, generalized HSDD.”* This article was originally published here

said Carl Spana , Ph.D., President and Chief Executive Officer of Palatin

Post a Comment