5 Penny Stocks To Watch When You’re Short On Time $TEUM $FCEL $DMPI $PTI

Penny Stocks Are Known For Volatility But What About Ones That Aren’t?

We can all agree that penny stocks are incredibly volatile. If you’ve been trading for a while or even if you’re brand new to penny stocks, you’re likely attracted to one thing: making big money. Now, this “big money” doesn’t need to be based on pure dollar figures but percentage gains.Obviously a 100% gain on whatever money you have is significant in a relative meaning. This being said, what if you work a full-time job? How in the world can you find the time to buy penny stocks and sell them within hours or even minutes?

Many people avoid stocks entirely because they simply don’t have time to watch the market. This is at no major fault of their own. But it’s easy to fall prey to this thinking. It’s very important to learn to trade penny stocks before jumping in headfirst.

So, what do you do? Well, neither TransparentTraders.me nor I am a licensed financial advisor. What we do here is report on the market and certain trends. But if you’re short on time during the day and can sporadically look at the market, you may want to find penny stocks that steadily hold a trend.

Penny Stocks To Watch When You’re Short On Time

Easier said than done, I get it, but like all risky and volatile investments, you rarely get to “set it and forget it.” So as a disclaimer to this point, make sure you set time or set alerts for when stocks are hitting certain levels. You may even want to read up on stop-losses as these can be the ultimate safety net when it comes to the time you can’t stay glued to your trading platform.

New To Penny Stocks? Check Out Some Of These Articles For Beginners

When we talk about trends, we’re talking about chart trends. Paying close attention to things like volume, price, penny stock news, and economic events in many cases. A penny stock may hold a great consistent trend but if it’s a gold penny stock and all of a sudden interest rates change, this could send an echo across the entire sector. In this example, the company might have been doing everything right but as they say, “A rising tide and lift or lower all ships.”New To Small-Cap Stocks? Check Out Some Penny Stocks 101 Articles

As we approach the end of October and head into November, here are a few penny stocks to watch that may not have seen overnight explosiveness, but they currently have a steady trend.

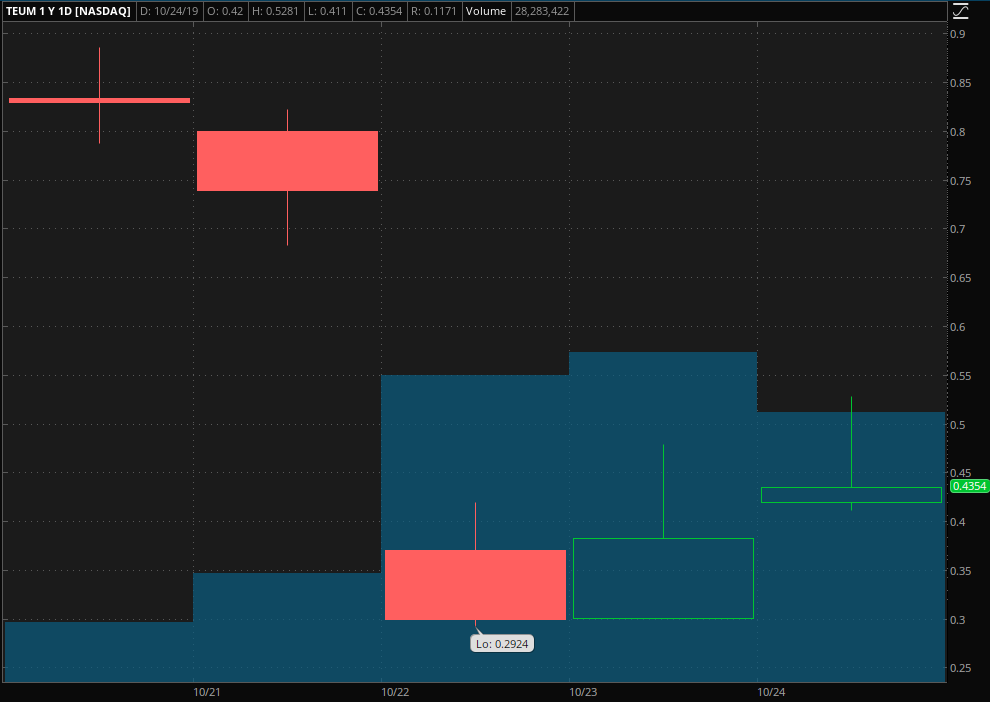

Pareteum Corporation (TEUM)

This has been a rough year for Pareteum Corporation (TEUM Stock Report ). Shares started the year out around $1.70, saw highs of almost $6 and have tanked ever since. Just a few days ago TEUM stock hit 52-week lows of $0.294; yes under $0.30 from almost $6 this year.The company announced earlier this week that it will restate its earnings statements. Following this was a bunch of analysts downgrades as well as a slew of class action claims.

So, why in the world would this be a penny stock to watch in November and the rest of October? Well, since hitting those lows, shares of TEUM have held a 3-day uptrend. Furthermore, the stock has seen more daily share volume during the last few days than it ever has.

Is this interest building or just speculative bullishness? At the end of the day, it may be a company to watch. After reporting that it will realize a bigger hit than expected – something negative – the market seems to actually be picking up steam at sub-$1 levels.

FuelCell Energy Inc (FCEL)

This has been a popular penny stock to watch over the year. Unfortunately, it hasn’t been a great example of “buy and hold.” In fact after opening the year above $6 a share, FuelCell Energy (FCEL Stock Report ) stock has dropped by as much as 98%.[Read More] Top Penny Stocks To Add To Your Watch List Before November?

The 52-week lows were hit this year and weighed in at $0.134. This week, FCEL saw trading levels above $0.32 and since the middle of the month, FuelCell stock has climbed 17%. Even with this being the case, shares are down significantly from the beginning of the year.

After dropping to mid-month lows of $0.263 following the latest capital raise, FCEL stock began to rally. The company has entered a deal with E.ON Business Solutions to develop the European Market. E.ON is a German company specialized in energy solutions for commercial, industrial and public energy clients.

“E.ON owns two of our existing power plant projects already. Our solution is a perfect fit for a number of needs throughout Europe, offering both distributed cost-effective energy for sub-megawatt applications, and large scale multi-megawatt continuous clean power for industrial and utility-scale applications. With this collaboration, together, we will be able to offer customers across Europe flexible financial solutions,” explained Jason Few, President and Chief Executive Officer of FuelCell Energy.

Granted this is a highly volatile penny stock so the big question is can this latest trend hold or is FCEL stock poised for another downturn?

DelMar Pharmaceuticals, Inc. (DMPI)

Third, on this list of penny stocks DelMar Pharmaceuticals, Inc. (DMPI Stock Report ) focuses on cancer treatments. Its current pipeline is hinged on its VAL-083, which is a chemotherapy demonstrating “clinical activity” against certain cancers. Over the last few months, DelMar has been hitting the convention circuit.Most recently the company announced that it will be presenting at the Dawson James Small Cap Growth Conference at the end of the month. Company CEO, Salid Zarrabian will be giving an overview of the company’s business model and growth strategy.

What has caught attention lately came in the form of a new uptrend mid-October. Similar to FCEL, DMPI stock hit a 52-week low this month. However, following this, shares began to steadily uptick. With 52-week lows of $0.402, DMPI stock has managed to steadily rise by as much as 43%. Can this trend continue into November?

Proteostasis Therapeutics (PTI)

Another biotechnology name on the list of penny stocks, Proteostasis Therapeutics (PTI Stock Report ) has held a solid 3-day uptrend this week. What helped get the ball rolling was the company announcing that it will host a Cystic Fibrosis Summit. The summit is scheduled for October 28.Following this, the company published news that it will gain highlights in five presentations at an upcoming Cystic Fibrosis Conference in Tennessee. Could this latest bull move be speculation on the outcomes of these conferences?

The jury is out on this. However, we’ve already seen biotechnology stocks rocket during periods leading up to big events. Though conferences may not appear a vital event, those in attendance get direct exposure to the horse’s mouth.

Especially when it comes to therapeutic companies, the more people a company can reach, usually the better. In the case of PTI stock, it has reacted favorably over the last few days. Can that continue into the early part of November as the Tennessee convention kicks off?

Fannie Mae (FNMA)

Last but not least is a familiar face, Fannie Mae (FNMA Stock Report ). We saw this penny stock explode over the last few months. Excitement about the firm leaving the grips of government power and going back to private hands has built a following around this penny stock.One thing’s certain for “cult-like” penny stocks, they have eyes on them constantly. Over the last few weeks, shares of FNMA stock were hit by bad economic news. However, this week may have been a turning point.

But before Fannie Mae (and cohort Freddie Mac) can be privatized, they’ll need to raise money. Bank of America, Citigroup, Goldman, JPMorgan, and others have discussed with regulators about how a raise might work. This is according to those close to the situation as reported by the Wall Street Journal.

This move seems to have breathed new life into FNMA stock (for now). Can this trend continue as Fannie Mae has booked a remarkable year so far or is this just one more step toward the next bear trend?

* This article was originally published here

Post a Comment