Uber stock is in crisis — here's the biggest problems right now $UBER

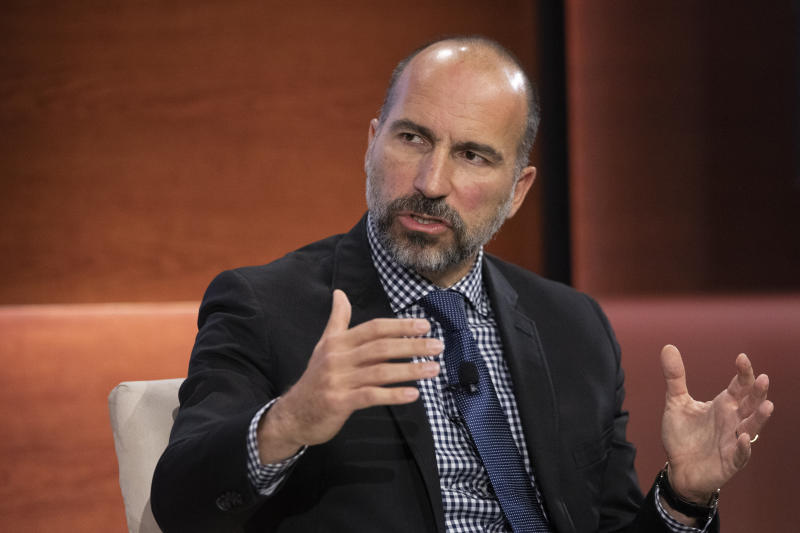

It’s getting straight up embarrassing for Uber CEO Dara Khosrowshahi. And if he doesn’t soften up his approach with Wall Street and communicate better to that influential cohort — as rival Lyft has done in recent quarters — it could be investors that incur further pain in a stock that has gone in the toilet since an overhyped IPO back in May.

Uber’s stock (UBER) crashed close to 9% on Tuesday following the ride-hailing giant’s decidedly mixed third quarter. The stock has plunged 38% from Uber’s May 10 IPO price. While it was borderline refreshing (we are searching for straws here...) that Uber’s massive loss per share didn’t completely whiff Wall Street forecasts, it was hard to overlook the inherent ugliness of the quarter.

Some things that stood out:

- Adjusted net revenue: $3.5 billion vs. $3.39 billion expected

- Adjusted EBITDA loss: $585 million vs. $805.1 million expected

- Gross bookings: $16.47 billion vs. $16.7 billion expected

- Ride-share bookings: $12.55 billion vs. $12.51 billion expected

- Monthly active platform consumers: 103 million vs. 107 million expected

- Business lines: Uber Eats, Uber Freight and other bets continue to bleed red ink. The core Uber Rides business saw adjusted EBITDA rise 52% to $631 million.

“Investors have a lot of questions around profitability,” Wedbush analyst Ygal Arounian said on Yahoo Finance’s The First Trade.

Khosrowshahi did his best impression (finally) of Lyft’s CEO Logan Green and outlined a path to profitability on the earnings call. The company expects to be profitable on an adjusted EBITDA basis in the full fiscal year 2021. If Uber would have did this months ago, the market would have probably embraced the long-awaited details on profits.

Arounian says Khosrowshahi and his team could do a better job holding the hands of Wall Street during this phase of growth and losses. The fact Uber only now offered more insightful bottom line guidance underscores Khosrowshahi’s lack of understanding on what investors need to hear from him.

This time around the market ignored the profit guidance, underscoring the growing lack of confidence in Uber’s management and sent the stock further into crisis mode. How else could one view the situation at Uber? You have a highly public CEO in Khosrowshahi telling the masses that profits are possible soon — an attempt to address one of the biggest mysteries in the tech space right now — and yet the stock is dumped.

Come on.

What else analysts are worried about on Uber

Besides Mr. Market tuning out Khosrowshahi’s promises, Wall Street remains concerned on several aspects of Uber based on Yahoo Finance’s conversations.

They include:

- Lyft continues to do a better job communicating their vision to the Street. Lyft also gets higher marks relative to Uber on delivering up to their promises.

- The outlook for Uber Eats over the next six months stinks. Not only is the business already losing large sums of money, but the losses could accelerate in the medium-term as struggling Grubhub dumps massive discounts into the market to drum up business (as they have recently signaled).

- Uber’s IPO lockup occurs on Wednesday. Analysts estimate about 1.7 billion in shares will become available for sale. Given the terrible performance of Uber and tepid outlook, a selling tsunami could transpire.

The bottom line

At this point, it’s wildly unclear what puts the bottom in Uber’s stock once and for all. Khosrowshahi took a shot at doing it with his long-awaited profit shout out. Perhaps early investors need to completely dump Uber — now that they will be able to —as to remove the lockup worries overhanging the stock. But hell, even that could spook other Uber investors — if early investors dump the stock, it could be a no confidence vote in management’s timeline on profitability.

The Uber stock crisis soldiers on.

Uber’s post-IPO share lockup period ended yesterday, exposing about 763 million tiny Ubers (about 44% of its outstanding shares) to the possibility of sale. Investors sent Uber stock to its lowest price ever.

ReplyDeleteWhat’s a lockup period? When early shareholders and executives are prevented from selling in the immediate aftermath of a company’s IPO. Lockup expiration can cause selloffs, even if the listing was initially successful (see: Pinterest).

Zoom out: Uber reported Q3 earnings on Monday. Revenue beat estimates, but bookings and user growth disappointed. Shares sank about 5% after hours Monday...and didn’t stop for the next two days.

Worse could be in store—some investors may have held off selling their shares yesterday because the stock is already underwater.

This means more trouble for SoftBank's Vision Fund, which holds a 16.3% stake in Uber. SoftBank reported its first quarterly loss in 14 years yesterday after a slew of writedowns, punctuated by WeWork.

Bottom line: Uber investors aren’t in agreement over the company’s direction, particularly the role of the delivery service Uber Eats. Still, it remains a global leader in the industry.