Best Penny Stocks To Trade Or Ignore This Week? $PCG $AWSM $TOPS

3 Penny Stocks To Watch Making Moves Before Friday

There is no exact science when it comes to making money with penny stocks. There are so many factors that are out of your control so it’s important to control what you can. For instance, if a penny stock trade turns sour you can set a stop-loss to reduce your potential losses.Trading penny stocks can be very lucrative if you trade with a game plan and identify the best penny stocks to buy. You should research stocks with news catalysts, increasing volume, or strong momentum. These key indicators are basic on the surface but can guide you on a path that could result in gain potential.

Other things you may want to take note of are certain penny stock chart patterns. They’re a bit more advanced but once you learn them it can help you further narrow down your list of penny stocks. To get you started with this research, here are a few penny stocks to watch on October 29th.

Best Penny Stocks To Trade [or Ignore]

PG&E Corporation (PCG)

PG&E recently became a penny stock falling beneath the $5 threshold on October 25th. While this is bad for the penny stock, it is fantastic for investors who feel this valuation is incorrect. I say this because after the stock fell, the company had increasing volume and put in a doji on the daily chart. After this doji, the trading session on October 29th led to a 18.6% gain as it attempts to reach $5 again.

Despite what the technicals may say, it’s also important to pay attention to current events. The huge troubles that California wildfires have caused don’t help power companies like PG&E. In fact, due to the threat, the company has actually needed to turn off power for millions of customers.

On top of that, reports have also surfaced showing that damaged equipment may have been a cause of fires over the weekend. Needless to say, shares of PCG stock have recovered for the time being. Could this continue into the week ahead?

Cool Holdings Inc. (AWSM)

Cool and Torque Esports Corp. recently announced a $3.15 million partnership. It is supposed to last 3 years between Simply Mac and Torque’s subsidiary, Ideas & Cars Ltd. Furthermore, it allows Simply Mac to be the sole supplier of Apple products for events produced by Ideas & Cars.

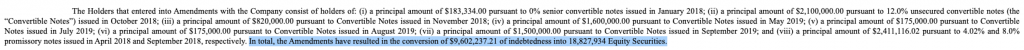

It’s also important to look at the filings here, however. Though we’re looking at AWSM stock at some of the lowest levels all year, the company’s filings are interesting. Over the last few days, Cool has released two 8-K filings. The outline certain amended conversion rights for upward of $16 million of the company’s debt. Without getting too long-winded, the items outlined include a conversion price of $0.51 a share. This may be “cool” at first but then read the fine print:

It states, “In total, the Amendments have resulted in the conversion of $9,602,237.21 of indebtedness into 18,827,934 Equity Securities.” Based on the latest trend and this information is AWSM a penny stock to trade or ignore this week in your opinion?

Top Ships Inc. (TOPS)

The company’s fleet is full of modern, fuel efficient “ECO” tanker vessels. As of now, Top Ships has a fleet size of 14 ships with an average age of 2 years making it one of the youngest fleets in the world.

Last week, the company’s stock got absolutely hammered falling from $4.31 all to way to $3.03, a 30% drop. However, Top Ship’s stock has bounced back during the next week. On October 28th it gained nearly 7.3% on above average volume.

After this trading session, the stock gapped up again on the 29th and is currently up 2%. Given the state of its above-average trading volume, will TOPS stock be one to watch or ignore before the end of the week?

* This article was originally published here

Post a Comment