Stock Ticker - Apple Inc. (NASDAQ : AAPL)

OUTLOOK 2019 : TRADE WAR AND STRONG ECOSYSTEM GROWTH

2018is a difficult year for company because their iPhone are slowing down and the effect of trade war between America and China. China has to pay excise up to 25 %, which is burdensome for company because of their production in China. Pegatron corporation which is the Apple patner in assembling the iPhone also moved its factory to Indonesia by cooperating with SAT Nusa persada Tbk. This will certainly benefit Apple and Pegatron, considering that the trade war has not been complete even though it is now peaceful for 90 days starting from 1 December 2018.

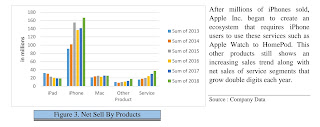

In the last few years Apple has begun to develop its business in a variety of product such as Apple TV, Apple Watch, AirPods, Beats Product, HomePods and other Apple branded and third party accessories and softwear upgrade right and non-softwear services. All of above products are cetegorized into other products by Apple and the growth of this segment is quite promising seeing the report of Apple sales in Americas, Europe, Greater China, Japan and The rest of Asia Pacific icreased double digit from 2016 and 2017.

Apple Inc posted $ 59,531 million net income as ended September 29, 2018 up 23 % yoy. The biggest income still comes from Iphone sales, although sales began to slow down last few quarter but this segment growth double digit with 18 % growth from $ 141,319 millons yoy. Apple hikes cost of good sold to solve this problem, other product segment growth 35 % from 12,836 yoy, services segment growth 24 % from 29,980 yoy, mac segment and ipad decreases -1 %, 2 % from 25,850, 19,222 yoy. This year 217,722 iphone, 43,535 ipad, 18,209 mac sold. No change for iphone and ipad but decreases -5 % for mac yoy.

Starting 2019 Apple Inc. via CFO Luca Maestri in earnings call cofference said that the company would not report moresales per unit for iPhone, mac and iPad. Thay will report it in a special report. According to Luca, this is because companies can sell their products at more varied prices and seeing the number of units sold is no longer the right indicator to see financial conditions.

2019First Quarter Apple Inc. Guidance :

•Apple Inc. set target is between $ 89 billion and 93 billion revenue for 2019 first quarter.

•Gross margin hike to between 38 percent and 38,5 percent

•Operating expense between $ 8.7 billion and 8.8 billion

•Other income/expense of $ 300 million

•Tax rate of approximately 16.5 percent before discrete items

•Apple Inc. set target is between $ 89 billion and 93 billion revenue for 2019 first quarter.

•Gross margin hike to between 38 percent and 38,5 percent

•Operating expense between $ 8.7 billion and 8.8 billion

•Other income/expense of $ 300 million

•Tax rate of approximately 16.5 percent before discrete items

It's going to be interesting how Apple stock shifts in the upcoming year. Since there have been talks about tariffs Apple continues to doubt if it should keep sourcing products through China. Although, it will be interesting to see how this all plays out in the next couple months.

ReplyDelete